How to Open a Company in Dubai – A Simple Guide for Europeans

Dubai has become one of the most attractive business destinations in the world. With its strategic location, tax-friendly environment, and advanced infrastructure, it offers unmatched opportunities for entrepreneurs and investors. For Europeans looking to expand into the Middle East or establish an international base, setting up a company in Dubai can be a game-changer.

If you’re wondering how to open a company in Dubai, this guide will walk you through the key steps, requirements, and reasons why so many European business owners are making the move.

1. Choose the Right Business Structure in Dubai

Before starting the setup process, it's crucial to select the appropriate legal structure. The three main options in the UAE are:

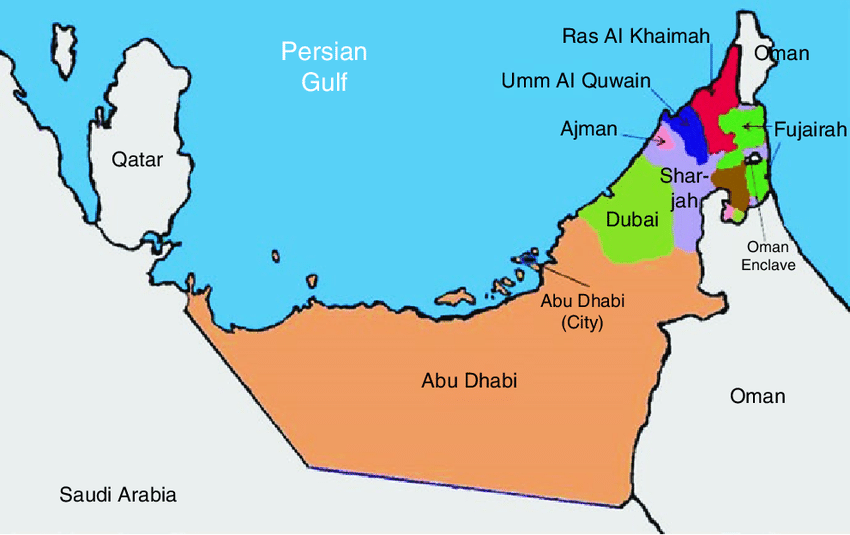

- Mainland Company – Allows you to trade anywhere in the UAE and take government contracts. Requires additional approvals but offers broader operational freedom.

- Free Zone Company – Offers 100% foreign ownership, streamlined procedures, and potential tax benefits. Best for international trade, consulting, tech, and services.

- Offshore Company – Ideal for asset protection, holding companies, and businesses not conducting operations in the UAE.

Choosing the right structure depends on your goals, customer base, and operational needs.

2. Define Your Business Activity

Dubai authorities require you to specify your business activity before issuing a license. Whether you're opening a consultancy, trading business, tech startup, or e-commerce platform, your activity must align with approved classifications. The UAE offers over 2,000 licensed activities, so you’re likely to find one that fits.

3. Choose a Company Name

Your business name must follow UAE naming rules. It should:

- Reflect your business nature

- Avoid offensive language or references to religion

- Not use abbreviations (unless they are part of your legal name)

Make sure your chosen name is available and reserve it early to avoid delays.

4. Apply for a Business License

Based on your activity and structure, you’ll need to apply for one of the following:

- Commercial License – for trading activities

- Professional License – for services and consultancies

- Industrial License – for manufacturing or production

If you're setting up in a free zone, the process is typically faster and involves less paperwork.

5. Register Your Company and Open a Bank Account

After choosing your legal structure and receiving initial approvals, you’ll need to:

- Submit your documentation (passport copies, application forms, business plan, etc.)

- Register your business with the appropriate authority

- Open a corporate bank account with a UAE-based bank

Each free zone or mainland authority has its own process, and using a local consultant can save time and reduce complications.

6. Apply for a UAE Residency Visa and Office Space

Once your company is registered, you can:

- Apply for your residency visa

- Sponsor visas for employees or dependents

- Choose an office solution: flexi-desk, shared space, or a dedicated office

Some free zones offer virtual office packages that meet legal requirements at lower costs, which is ideal for startups or remote businesses.

Why More and More Europeans Are Starting Businesses in Dubai

High quality of life and modern lifestyle for expatriates

Business-friendly laws and efficient administrative procedure

Access to international markets via world-class logistics

No currency restrictions

100% foreign ownership in many free zones and eligible mainland activities

Corporate income tax is only 9% and applies only to profits exceeding AED 375,000 – many free zone companies remain tax-exempt if they meet qualifying criteria

0% personal income tax

Why Work with a Local Partner?

While setting up a business in Dubai is relatively straightforward, it’s highly recommended to work with a local business advisory partner who understands the local laws, tax implications, and licensing requirements.

A trusted partner helps:

- Select the best jurisdiction (mainland vs. free zone)

- Navigate legal and compliance steps

- Minimize tax burdens

- Open bank accounts quickly

- Ensure long-term success in the UAE market

At Emirates Advisors, we provide end-to-end support—from choosing the optimal company structure (LLC, Free Zone Entity, or Branch) to navigating taxation, licensing, and visa matters.

Ready to Start?

Let Emirates Advisors support you every step of the way. Our local partners provide expert advice and take care of all formalities—from business structure selection to visa processing.

Learn more and get started here: Emirates Advisors