Why Do Europeans Invest in Apartments in the Emirates?

The United Arab Emirates (UAE) has emerged as one of the world's most attractive destinations for real estate investment, especially for European buyers. Beyond the glitzy skyscrapers and year-round sunshine, investors are drawn by a combination of lifestyle benefits, capital appreciation, and flexible financing options.

1. Escape the Cold Winters – Enjoy with Family

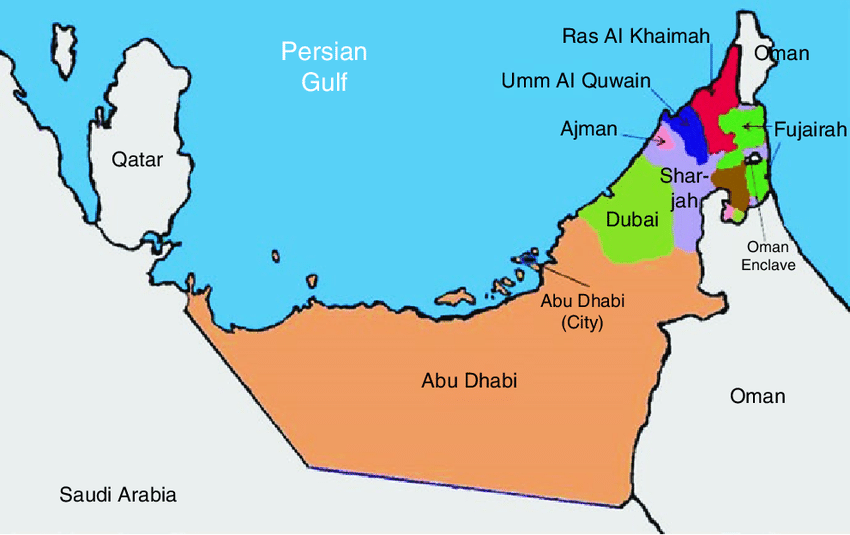

For many Europeans, owning an apartment in Dubai, Abu Dhabi, or other Emirates is a lifestyle choice. The UAE offers a sunny escape from the long, cold winters of Europe. Families often purchase apartments to spend part of the year in a warm, safe, and family-friendly environment with world-class amenities, beaches, and entertainment options.

2. Capital Appreciation – A Smart Investment Strategy

In addition to lifestyle reasons, many investors buy to capitalize on the UAE’s growing real estate market. Property prices have been rising steadily in recent years.

According to Property Finder and CBRE data, Dubai property prices alone increased by over 20% in 2023, marking one of the highest growth rates globally. This trend is expected to continue due to limited supply in prime areas, high demand, and the UAE's business-friendly policies.

3. Off-Plan Investments – Profit Before Completion

One unique advantage in the UAE is the popularity of off-plan purchases. Buyers can invest in properties that are still under construction, paying 30% to 60% upfront. Often, these properties appreciate significantly even before completion, allowing investors to resell at a profit without ever waiting for handover.

4. Profitable Rental Options – Short-Term or Long-Term

Many investors do not intend to live in the property themselves but instead rent it out:

- Short-term rentals: Platforms like Airbnb or Booking.com are widely used, and multiple local companies offer property management services, ensuring your apartment is rented, maintained, and your income is hassle-free.

- Long-term rentals: For investors not planning to use the property personally, long-term rentals provide stable returns and are in demand, particularly in popular expat neighborhoods.

5. Financing – Mortgage Options for Foreigners

Did you know that European buyers can get a mortgage from UAE-based banks, even if their income is from outside the UAE?

However, better conditions are available if you have a business in the UAE, as local income opens doors to higher loan-to-value (LTV) ratios and more favorable terms.

At Emirates Advisors, we can assist you in opening your company in the UAE, handling bookkeeping, and advising on tax matters, giving you not only business opportunities but also stronger eligibility for local financing.

6. Work with Trusted Developers & Agents

Whether you're buying for personal use or investment, working with reliable, certified real estate agents ensures your purchase is secure.

We can connect you to trusted agents who work with the best developers, such as Sobha, Binghatti, and Emaar, ensuring quality and peace of mind.

7. Affordable pricing

Contrary to popular belief, the price level of real estate in UAE is comparable to European average. You can often buy ready to move in apartments, in the less popular but high potential regions at prices much lower than in Western Europe

➡ Click here to learn more about real estate investment in the UAE

Conclusion

Investing in UAE apartments is not only about sunny getaways—it's a strategic move for capital growth, rental income, and future financial flexibility. With tailored support from Emirates Advisors, you can navigate the process confidently, whether you're looking to buy, rent, or open a business in the Emirates.

#EmiratesAdvisors #RealEstateUAE #DubaiProperty #InvestSmart #OffPlanUAE #ApartmentInvestment